Compliance Risks in AI Sales Agent Development for Professional Services

Professional services firms deploying AI sales agent development face four high-risk compliance exposures that standard SaaS tools sidestep—and regulators are watching.

Risk 1: Unauthorized Practice of Law/Accounting (Bright-Line Violations)

Scenario: AI sales agent fields inbound inquiry, diagnoses client need, proposes service scope, quotes fee—without licensed professional review.

Exposure:

- Legal: Unauthorized practice of law (UPL) in California = Bar complaints, injunctions, disgorgement of fees collected

- Accounting: Unlicensed tax advice = CBA violations, civil penalties

Example: AI agent tells prospect “you need an S-corp election” without CPA review. Advice is wrong. Client files incorrectly, owes $40K in taxes. Client sues. Firm’s E&O insurer denies claim (AI not covered under standard policies).

Mitigation:

- Limit AI to scheduling, intake, and information collection—not advice

- Hard-stop before scope/pricing: “A licensed [attorney/CPA] will review and confirm”

- Audit logs showing human reviewed every client-facing recommendation

- E&O policy endorsement covering AI-assisted client interactions

Risk 2: Data Privacy Violations (CCPA/GDPR in Multi-State Practices)

Scenario: AI sales agent ingests prospect email, phone, business details. Data stored on third-party AI provider servers. No BAA. No data processing agreement.

Exposure:

- California (CCPA): $7,500 per intentional violation. Class action risk if breach occurs.

- EU prospects (GDPR): €20M or 4% global revenue, whichever is higher.

- State Bar (attorneys): Client confidentiality violations = disciplinary action.

Example: AI provider suffers breach. 3,000 prospect records exposed, including financial details shared during intake. Firm faces CCPA class action + Bar investigation.

Mitigation:

- Vendor contracts: data processing agreements, breach notification terms

- Data minimization: AI captures only necessary fields

- Retention limits: auto-delete prospect data after 90 days if no engagement

- Opt-in consent: “By submitting, you agree to AI-assisted processing”

Risk 3: Discrimination & Bias (Protected Class Violations)

Scenario: AI sales agent qualifies leads based on firm size, industry, geography. Model inadvertently filters out businesses in certain ZIP codes (proxy for race/ethnicity).

Exposure:

- Fair Housing Act: If serving real estate clients, ZIP-based filtering = discriminatory practice

- Civil Rights Act (Title II): Refusing service based on protected characteristics

- Reputational: Media coverage of “AI redlining” by professional services firm

Example: Law firm’s AI agent deprioritizes leads from historically Black ZIP codes because training data showed lower conversion rates. Pattern detected via audit. Firm faces DOJ investigation.

Mitigation:

- Bias testing: audit AI decisions across protected classes quarterly

- Transparent criteria: publish lead qualification standards (no opaque scoring)

- Human review: all declined leads reviewed by licensed staff

- Vendor accountability: require AI providers to conduct bias audits

Risk 4: Malpractice Exposure from AI “Hallucinations”

Scenario: AI agent answers prospect’s legal/tax question incorrectly. Prospect relies on misinformation, suffers financial harm, sues for negligence.

Exposure:

- Professional liability: Even if no engagement signed, courts may find duty of care based on reliance

- E&O claims: Standard policies exclude “advice provided by automated systems” unless explicitly covered

Example: AI tells tax prospect “charitable donations are 100% deductible” (false). Prospect donates $200K, gets audited, owes $60K. Sues firm. E&O insurer denies. Firm pays out-of-pocket.

Mitigation:

- Disclaimers on every AI response: “This is not legal/tax advice. Consult licensed professional.”

- No substantive answers: AI redirects technical questions to human consultations

- E&O endorsement: negotiate “AI-assisted services” coverage ($5K-$15K/year premium add)

- Monitoring: log all AI interactions, flag risky responses for review

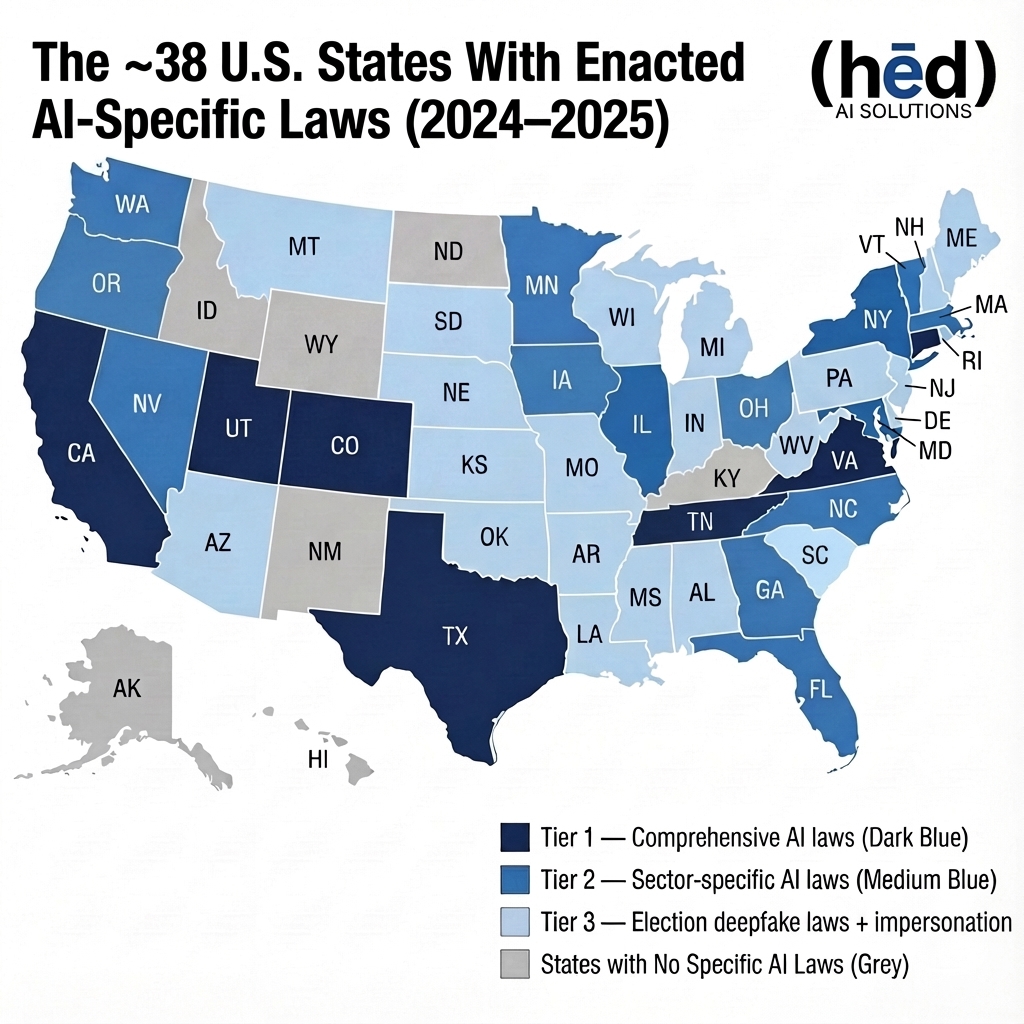

Regulatory Landscape (2025 Forward)

California Bar (Legal): Proposed rules require disclosure when AI drafts client-facing documents. Non-compliance = ethics violations.

AICPA (Accounting): Guidance pending on AI use in tax prep and audit. Expect mandatory human review requirements.

FTC (All sectors): Increased scrutiny on “deceptive AI claims.” Overstating AI agent capabilities = unfair trade practice.

Implementation Checklist (Compliance-First AI Sales Agents):

- ☐ Legal review: Outside counsel validates AI use complies with professional licensing rules

- ☐ E&O coverage: Confirm policy covers AI-assisted client interactions or purchase rider

- ☐ Vendor contracts: Data processing agreements, liability allocation, breach terms

- ☐ Disclosure policy: Every AI interaction shows “AI-assisted” label

- ☐ Human gates: Licensed professionals review before service commitment or advice

- ☐ Bias audit: Test AI decisions across protected classes pre-launch + quarterly

- ☐ Incident protocol: Plan for AI error discovered post-launch (who reviews, who notifies clients)

Cost of Non-Compliance:

Scenario: 25-attorney firm deploys AI sales agent without compliance review. Agent provides unlicensed advice, discriminates against certain industries, suffers data breach.

Exposure:

- State Bar investigation: $50K legal defense

- CCPA class action settlement: $180K

- E&O claim (denied): $90K out-of-pocket settlement

- Reputational damage: 15% client attrition

Total cost: $320K + lost revenue

Compliance investment to avoid: $12K-$18K (legal review, E&O rider, vendor contracts, bias testing)

Professional services firms that treat AI sales agents as “just software” face existential compliance risk. Those that implement with legal rigor capture competitive advantage—without betting the firm’s license.